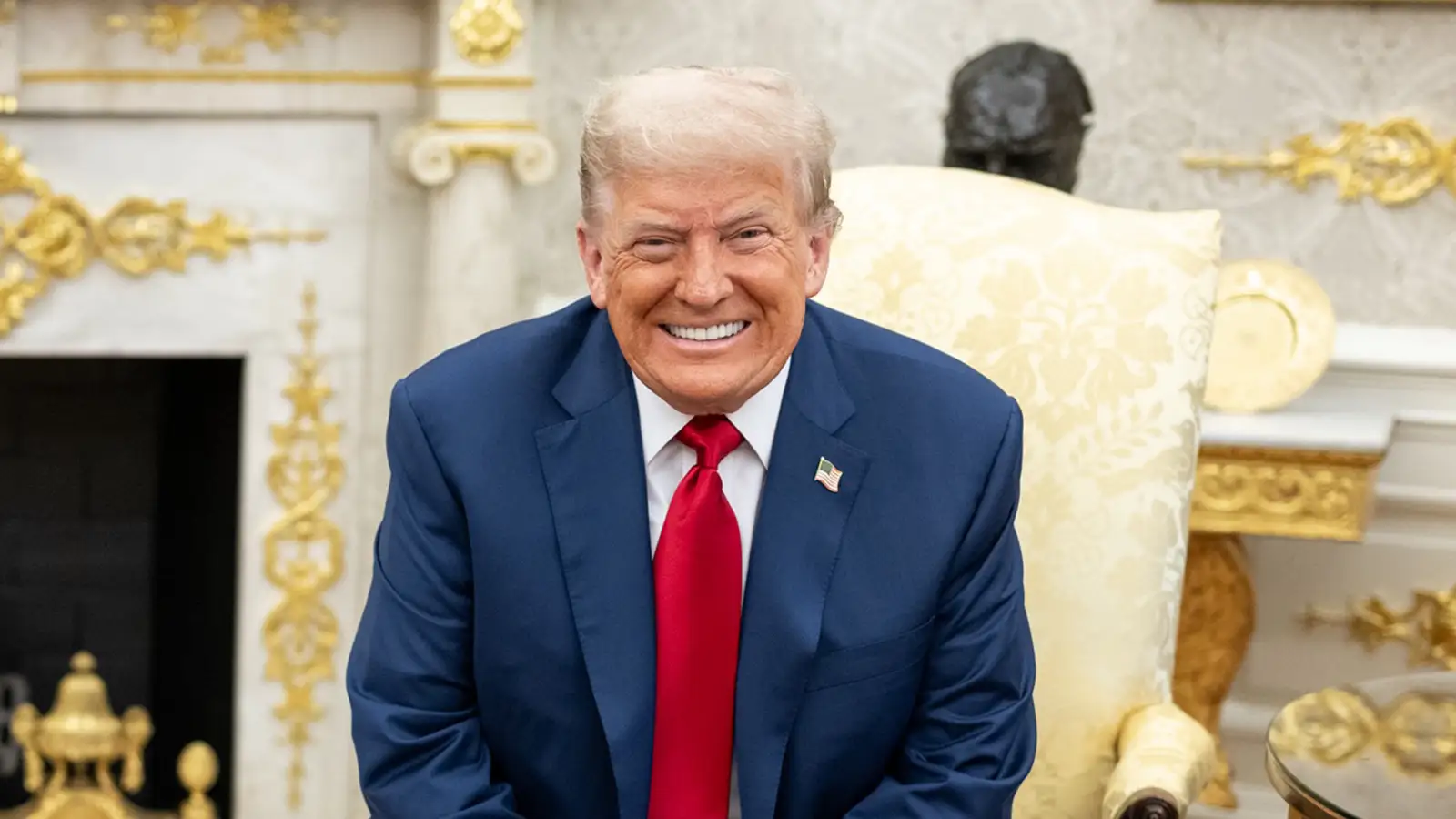

In June, inflation in the United States was once again the talk of the town. The consumer price index rose by 2.7% compared to the same month last year.The reason? The famous tariffs pushed by President Donald Trump are starting to be felt directly in consumers’ pockets.

To better understand: tariffs are taxes levied on imported products. And if those products go up in price, well, it’s quite likely that we consumers will end up paying more for them. Exactly that is happening with items such as appliances, furniture, clothing and even toys.

What do the numbers say?

According to the Labor Department, the increase was three-tenths over May, when annual inflation was 2.4%. In addition, “core” inflation – which does not consider the most volatile prices such as food and energy – stood at 2.9%, which was just what analysts expected.

In monthly comparison, i.e. from May to June, prices rose 0.3%. This may not seem like much, but it is the largest monthly increase in five months. And while not all sectors rose, some increases were quite evident:

- Non-alcoholic beverages rose 1.4%.

- Coffee (alert for coffee drinkers!) was up 2.2%.

- Fruits and vegetables, up 0.9%.

- Gasoline rose 1% in a single month.

- Electricity and natural gas also increased.

- And prices of items such as household appliances continued to rise for the third consecutive month.

In contrast, some products such as grains, meat and used cars fell slightly in price. But overall, consumers are paying more.

So what does Trump have to do with all this?

For months now, Trump has been pushing a fairly aggressive trade policy. He has placed tariffs of 10% on all imports, 50% on steel and aluminum, 30% on Chinese products and 25% on imported cars. He even threatened to impose a new 30% tariff on European Union products starting in August.

Economists had been warning for some time that these taxes would end up affecting the final price of many products. In June, this impact was finally reflected. Companies could no longer contain costs and began to affect consumers in the United States.

What does the Federal Reserve say?

This increase in inflation puts the Federal Reserve (the “Fed”), which decides whether to raise or lower interest rates, in an uncomfortable situation. For now, they have kept the rate between 4.25% and 4.5%, but the pressure from the White House is strong.

Trump has been very insistent that the Fed should lower interest rates, assuring that “there is no inflation” and that a reduction would help people buy houses more easily. But Jerome Powell, Fed chairman, is standing firm: he prefers to wait and see what effects the tariffs have before moving rates. This has not gone down well with Trump, who has even publicly criticized the official, calling him “Mr. Too Late”

So what’s next?

The Fed will meet on July 30 to discuss its next move. Experts believe there will be no change on that date, but some are betting that there could be a small reduction in September. It will all depend on how inflation evolves and what effect the tariffs continue to have.

In short: prices are rising, and much of that has to do with Trump’s trade policies. If this continues, it could not only complicate the U.S. economy, but also affect the Federal Reserve’s decisions… and, of course, generate more political tension in a year that is already shaping up to be quite busy.

Leave a Reply