We’ve made bold predictions that Bitcoin could surpass the significant $100,000 milestone this year in 2024, and now the question is, are we still on track to reach this huge milestone, even after Bitcoin’s recent rally? Could we still see Bitcoin doubling from today’s price? We’ll finish assessing if we’re still on track to hit $100,000 in just over 10 months.

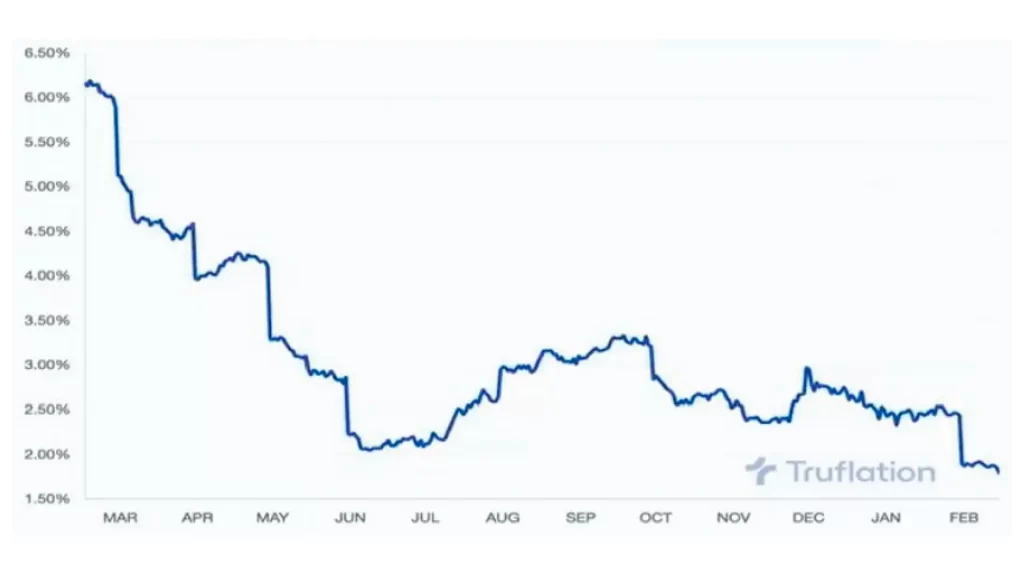

We have to discuss one thing that needs to move in crypto’s favor this year, and that is inflation. Now, this is a real-time inflation indicator by Truflation, and unfortunately, it’s not perfect; it’s not 100% accurate. However, it’s still useful as a guideline, as the recent data showed that there was going to be quite a significant drop in inflation, and although we did get a drop in CPI recently, it wasn’t quite as much as Truflation had predicted. Therefore, the trend was right, but the drop was not quite as much.

It’s also predicting that at the next CPI, there will be another significant drop. Therefore, this would bring us down to the 2% range. However, the main point is that inflation has to keep moving our way; the trend needs to keep coming down, and then it’s great for risky assets. However, if inflation is sticky and begins to move back up, it means interest rates have to stay high, which is like putting a brake on the economy. If something goes wrong, as if inflation is high, you cannot then print loads of money to solve it. This is one of the differences this year, which does mean that we have more fun this year than in 2021, although I am sure no one wants to see another pandemic.

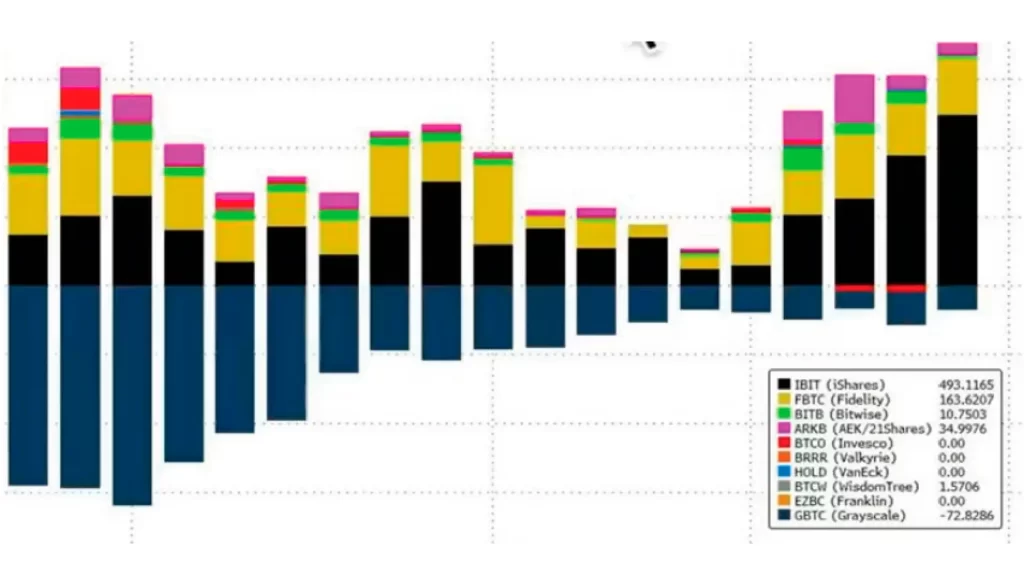

Now, this is the crazy thing going on with the Bitcoin ETF and where the money is flowing. So, at launch, there was significant buying and significant selling, but all the selling was coming from Grayscale’s products, and these are the people who were locked into this product and were unable to sell it for many, many months as they were going through the court battle.

So finally, it’s converted to an ETF, and people are able to sell their Bitcoin. So, there was significant selling initially, and it was a close battle between new people buying and people getting out of Grayscale. However, what we’ve seen is that this is now diminishing, so the people that were going to sell have pretty much sold. This is one of the main reasons why the price is starting to climb for Bitcoin and the crypto market.

However, most recently, it’s BlackRock in black that is now dominating the inflows. So, if this trend continues, then it’s just giving unprecedented demand for Bitcoin. So, this is really good to see.

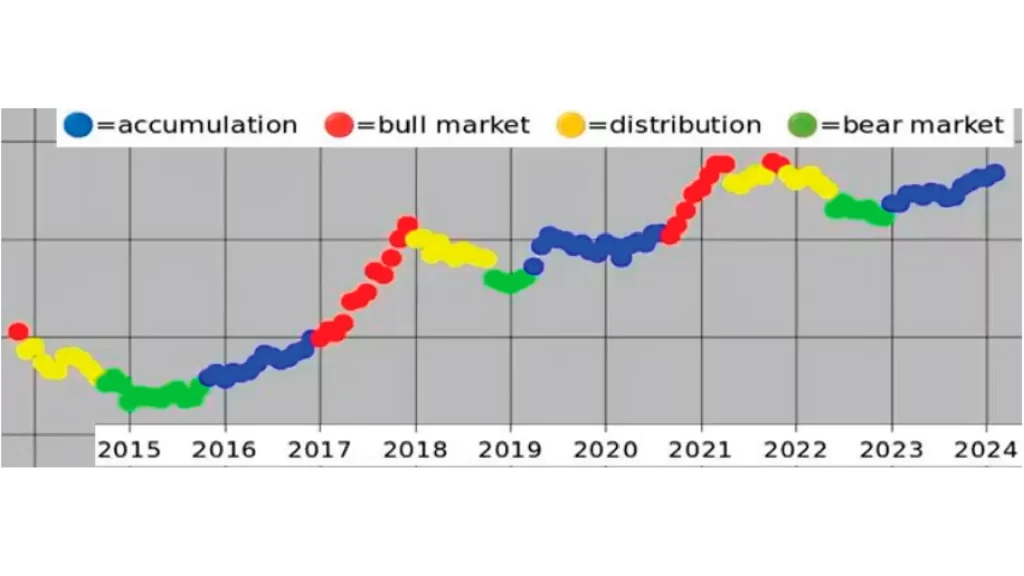

As promised, this was the one chart recently put out by Plan B, which should be very exciting for all crypto investors. Now, the good thing about Plan B’s charts is that they are incredibly simple, very simple patterns, color-coordinated, that show people what’s going on in the crypto market. So in the four parts here in red, we have the big bull market, then we have distribution or selling into the bear market, and then an accumulation stage. This pattern just repeats and repeats.

The one thing that should be exciting people right now is that we have had this distribution stage into a nasty bear market. But if you are liking what is going on in crypto right now and you’re liking that your portfolio is increasing every single day, every week, and every month. The great news is that we are still in the accumulation phase; we have not even started the big bull market stage. This is where you see the serious gains. The good news is that it has not even started right now. It is just a warm-up show.

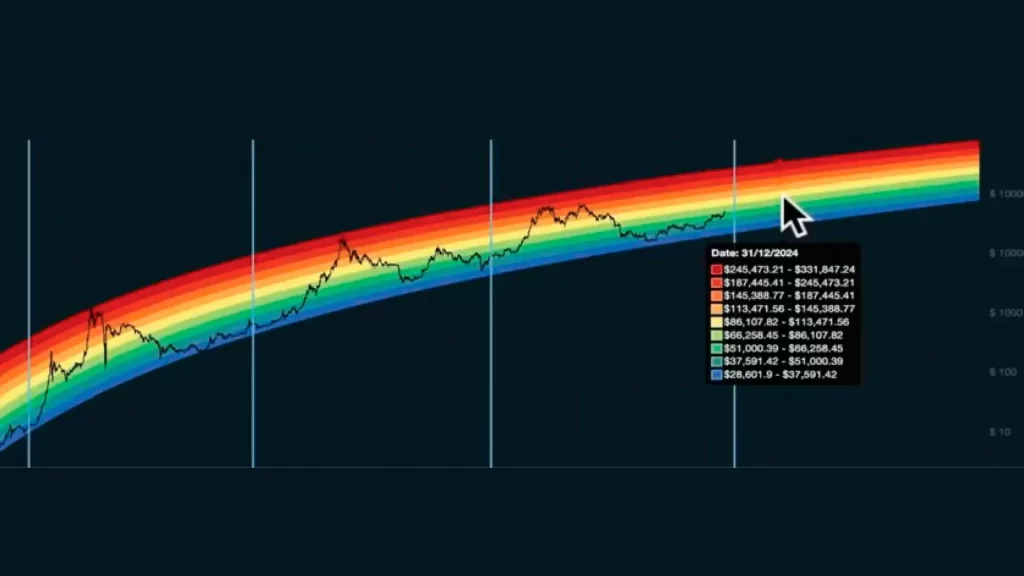

Finally, finishing up with a log-regression chart nicely shows the cycles and where we are at right now. So, we’ve definitely had a very good run recently, which has now just brought us into the still-cheap category by this chart. If we project forward, we look by the end of 2024, and then we look at the different categories, we can see that the central band, that yellow one, is saying it is a range between $86,000 and $113,000. This is just the midrange. So by the end of the year, this still suggests that we’re on track for the $100,000.

We made the bold prediction that Bitcoin could be breaking above the huge milestone of $100,000 this year. Now, unlike 2021, where we had macro tailwinds of low rates, lower inflation, and the money printer, this time we have to acknowledge that we have macro headwinds of high rates, higher inflation, and a hesitant Fed. For the $100,000 to be a dead cert, we need inflation to be moving in the right direction, that is, down. The Bitcoin ETFs need to keep giving a fresh supply of new demand with a nice supply shock from the halving and definitely no black swan events.

Leave a Reply