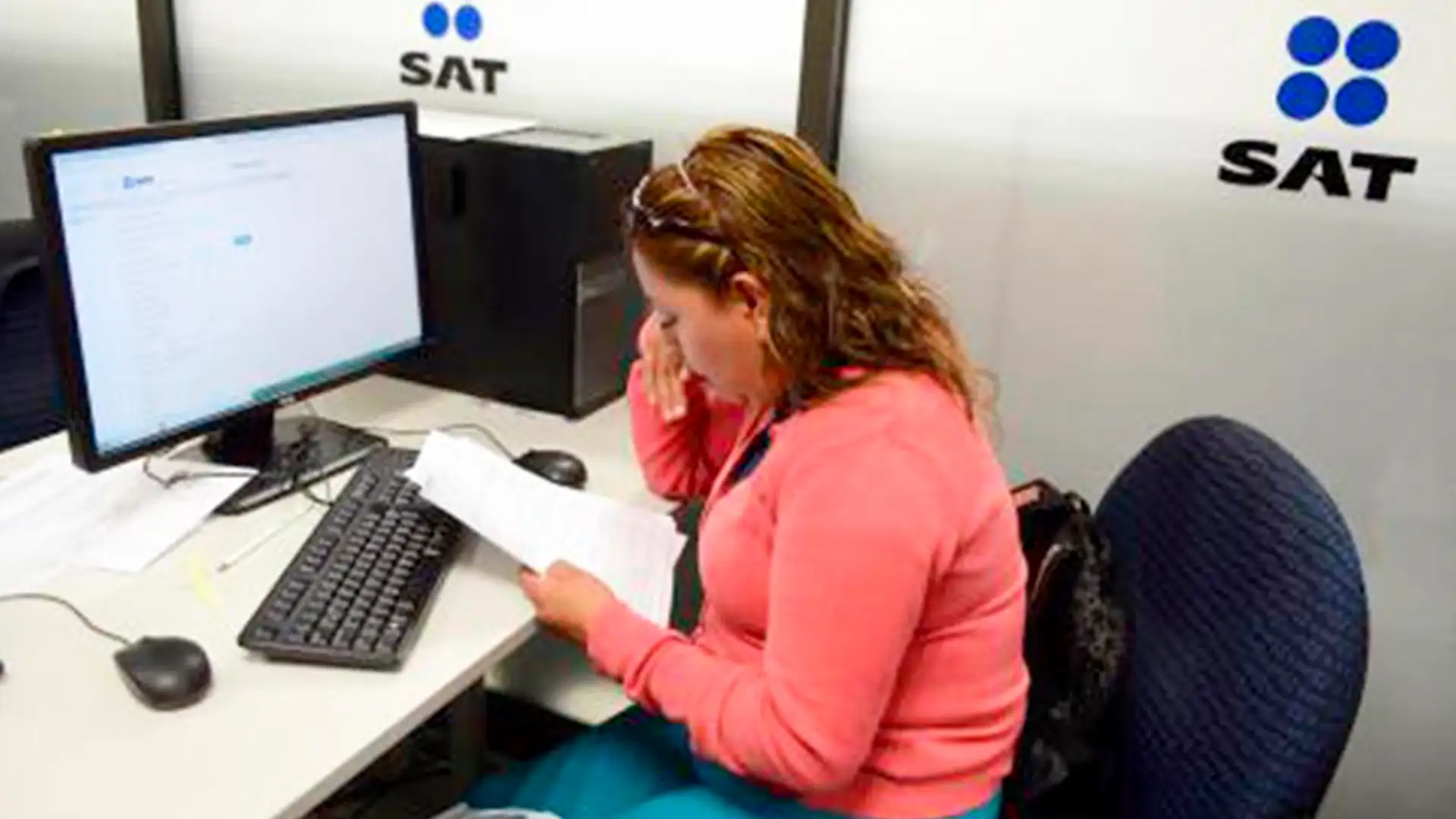

In the absence of tax reform in 2023, the Tax Administration Service (SAT) in Mexico will increase audits and inspections through electronic reviews and carry out more detailed reviews through the new CFDI 4.0 electronic invoice that will provide more information to the authority.

The foregoing warned the tax lawyer Jorge Alberto Pickett Corona, who explained that in the last 5 years in the six-year term of Mexican president Andrés Manuel López Obrador, there have been no increases, nor the creation of new taxes and for 2023, no tax reform was proposed.

He explained that the Federal Income Law (LIF) 2023 provides resources for $8.3 billion MXN, of which $4.6 billion MXN corresponds to taxes, while within the collection $2.5 billion MXN will come from Income Tax, $1.4 billion MXN from Value Added Tax and $486,212 million MXN of the Special Tax on Production and Services (IEPS).

Pickett Corona explained that the Taxpayer Defense Attorney’s Office (Prodecon) indicated in its tax prospective for 2023 that the SAT bets on a work program focused on increasing collection efficiency and collection without the need for prosecution, as well as using the powers that he obtained in the tax reforms of 2021 and 2022.

“The foregoing means that the Treasury will seek to strengthen the surveillance and control of taxpayer obligations, improve collection efficiency by obtaining relevant information and the use of available technology, and will continue to send invitation letters, obligations and messages of interest,” he said.

On the other hand, the tax lawyer commented that the electronic review is the exercise of a verification power of the SAT, but through the use of the tax mailbox and using information that the authority already has.

In this sense, he said that for the electronic review to be carried out, SAT will be based on four elements: the accounting information that the taxpayer has presented; the declarations; the CFDIs that are issued and not issued, and that must be stamped with the SAT and the information on income and expenses that is requested from the National Banking and Securities Commission (CNBV).

Jorge Alberto Pickett: “The Tax Administration Service, will give continuity to its examination strategy, but with an addition that is the new CFDI 4.0 electronic invoice, which will provide more detailed information on taxpayers.”

Similarly, it will also send emails to notify the taxpayer of inconsistencies in their invoices regarding the income received and declared or the Value Added Tax (VAT) paid against what was declared, among other examples.

“This strategy has worked well for the SAT because, although they are usually messages that can be annoying, sometimes they are useful for the taxpayers themselves to identify an error and correct themselves,” concluded the tax attorney.

Written by: Cuatro Comunicación

Leave a Reply