Written by Gina Dewar

Binational real estate refers to properties or real estate projects that are jointly owned or developed by individuals or companies from two different countries. It can involve cross-border investments, partnerships, or collaborations in the real estate sector. Binational real estate can be seen in border regions or areas with a significant presence of foreign investors or buyers from neighboring countries. It may involve shared ownership, development, or management of properties, and it aims to capitalize on the advantages and opportunities presented by cross-border cooperation in the real estate market.

Where is it headed in 2024?

It’s difficult to predict with certainty, but some trends may provide insight into where binational real estate could be headed in 2024.

One potential trend is the continued globalization of the real estate market, which may lead to increased cross-border investments and collaborations. Additionally, changing political and economic landscapes, such as trade agreements and policies, can impact binational real estate.

It’s important to stay updated with the latest market developments and consult experts for a more accurate forecast of the future of binational real estate in 2024.

How can I invest in real estate in another country?

Investing in real estate in another country can be an exciting opportunity. Here are some steps you can consider to get started:

1. Research the Market: Start by researching the real estate market in the country you are interested in investing in. Understand the current trends, property values, rental rates, and legal requirements for foreign investors.

2. Seek Local Expertise: It’s essential to seek guidance from local professionals who are familiar with the market and regulations. Consult with real estate agents, attorneys, and financial advisors who specialize in international property investments.

3. Analyze Investment Options: Determine your investment goals and preferences. Decide whether you want to invest in residential, commercial, or rental properties. Assess the potential returns, risks, and any specific rules for foreign investors.

4. Establish Financing Options: Explore your financing options, keeping in mind that obtaining loans as a foreign investor may have different requirements and conditions. Speak with local banks or financial institutions to understand loan eligibility and interest rates.

5. Understand Legal and Tax Implications: Familiarize yourself with the country’s legal and tax regulations related to real estate investments. Be aware of any restrictions, taxes, ownership rights, and residency requirements that may apply to foreign investors.

6. Visit the Location: Whenever possible, visit the location before making any investment decisions. This will give you a firsthand understanding of the local market and help you make informed choices.

7. Plan for Property Management: If you’re investing in a different country, consider how you will manage the property. Hiring a local property management company can help you handle maintenance, tenant screening, and other day-to-day tasks.

Remember, investing in real estate abroad involves unique challenges and risks. It’s crucial to do thorough research, seek professional advice, and stay informed about the local market conditions and regulations.

I can help you.

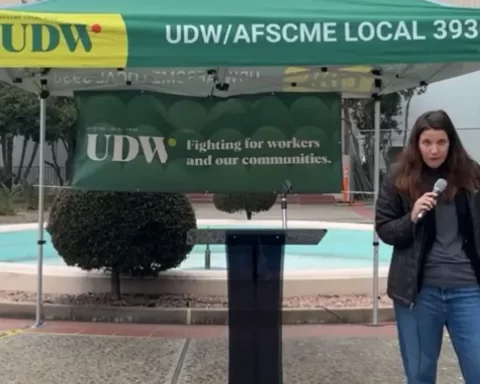

Gina Dewar

Cel. 915-321-1358

Binational Realtor

NewJourney Real Estate Group